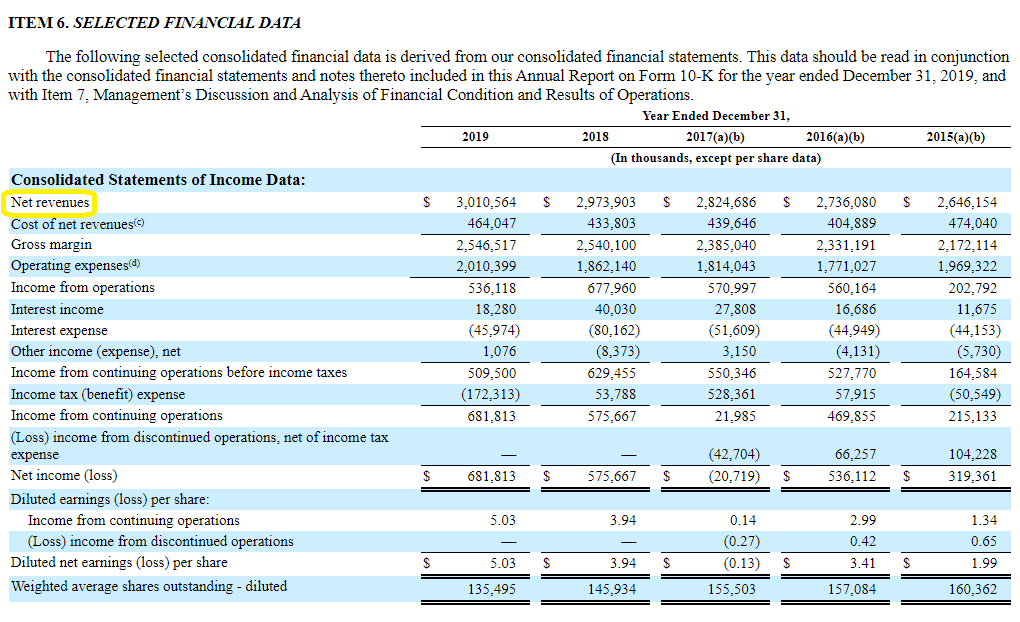

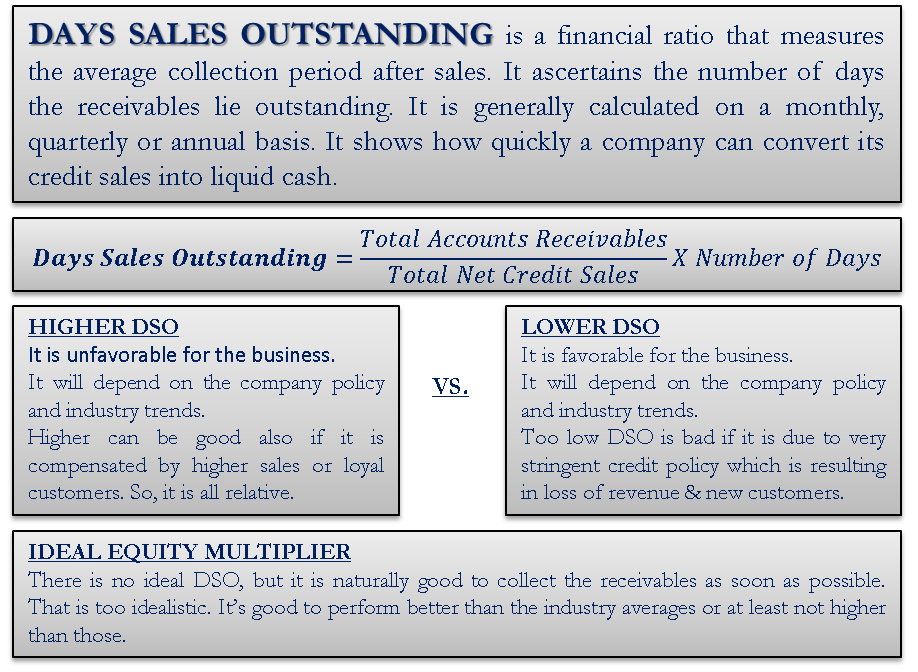

Day sales outstanding formula. Here’s an example to better show how the calculation works. Consider a company with revenue of $1 million and an average accounts receivable balance for the year of $150,000. You would calculate DSO as follows: ($150,000 / $1 million ) x 365 days = ~55 days.. Further, April has 30 days. Hence, the number of days is 30. He then refers to the DSO formula: DSO = Average A/R / Total Credit Sales (Number of Days) And performs DSO calculation: DSO = $22,500 / $45,000 (30) At this rate, Yo-han figures out that for the given period, it takes him 15 days to collect credit sales.

What is DSO/Days Sales Outstanding? Formula & DSO Calculation

How to Track & Report Days Sales Outstanding (DSO) in D365?

Dso days sales outstanding concept with big word Vector Image

Days Sales Outstanding Double Entry Bookkeeping

What is Days Sales Outstanding (DSO)? Formula + Calculator

How to Calculate Days Sales Outstanding (DSO) With RealLife Examples

Days Sales Outstanding Definition, Formula, Importance and Examples Marketing91

10 Steps to Reduce Days Sales Outstanding (DSO) & Improve Cash Flow

Days Sales Outstanding DSO FINED YouTube

Days Sales Outstanding (DSO) calculation and definition Billtrust

Days Sales Outstanding (DSO) calculation and definition Billtrust

Days Sales Outstanding DSO Importance and How to Calculate DSO

Calculate the Days Sales Outstanding in Excel PART 02 IVA Works YouTube

4 Ways to Reduce Your Company’s Days Sales Outstanding (DSO)

/5912231439_cfc556d2ac_k-541c05856c5e48e9a329126e8cdaa0c9.jpg)

Days Sales Outstanding (DSO) Meaning in Finance, Calculation, and Applications

Daily Sales Outstanding Calculator

How to Calculate Days Sales Outstanding (DSO) With RealLife Examples

:max_bytes(150000):strip_icc()/Term-Definitions_DSO.aspsketch-f812e865606b4128a29430805897b80c.jpg)

Days Sales Outstanding (DSO) Meaning in Finance, Calculation, and Applications (2023)

How to Calculate Days Sales Outstanding (DSO) + Formula

Days Sales Outstanding Define, Formula, Calculate, Analysis, Ideal DSO

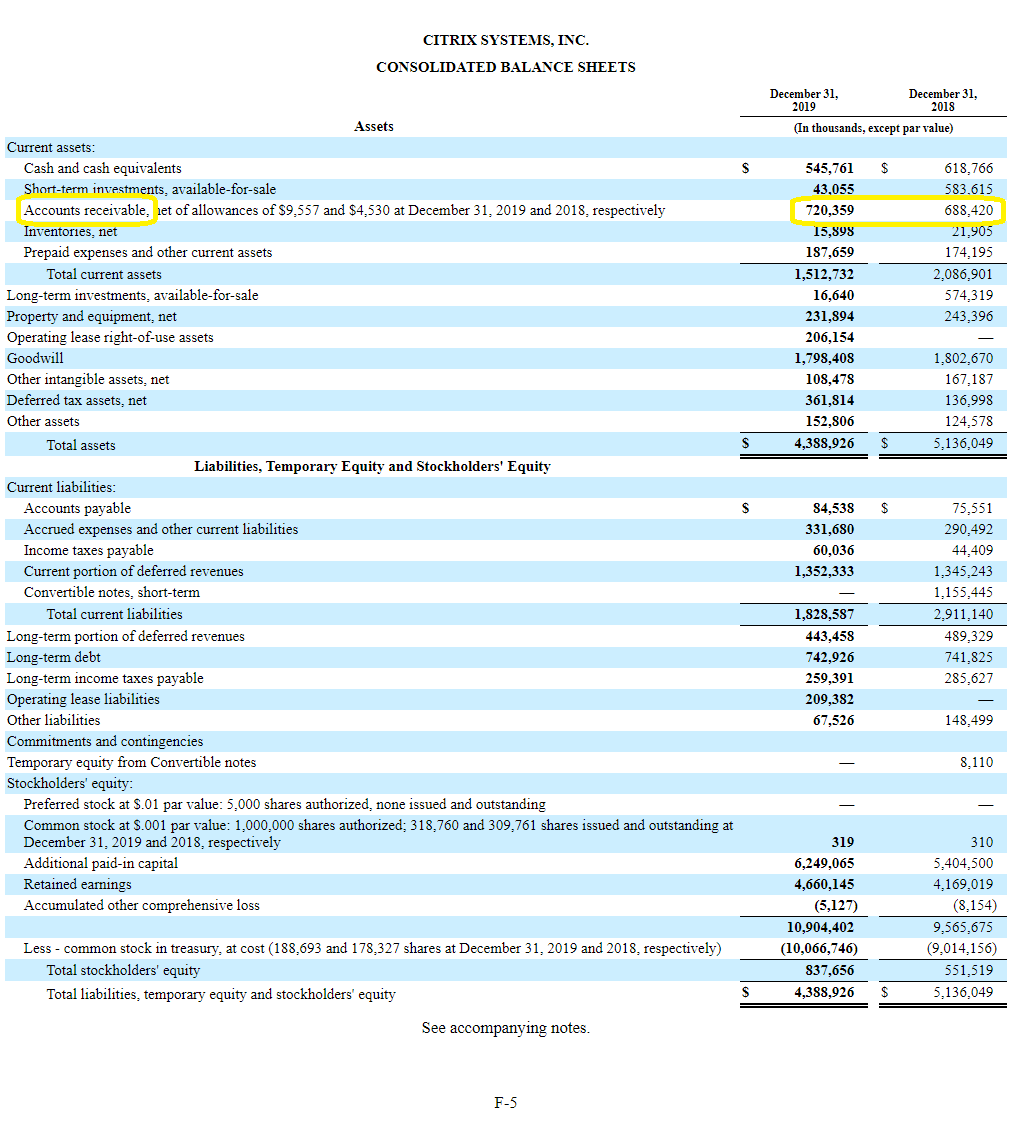

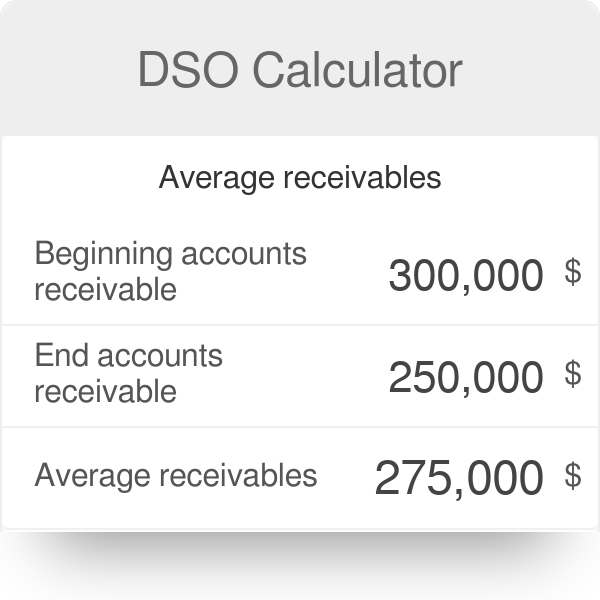

A high DSO may lead to cash flow problems in the long run. DSO is one of the three primary metrics used to calculate a company’s cash conversion cycle. What is the Formula for Days Sales Outstanding? To determine how many days it takes, on average, for a company’s accounts receivable to be realized as cash, the following formula is used.. The DSO calculator can help you take control of your finances. With it, you can calculate your debtors’ days outstanding, understand your credit risk exposure, and predict cash flow shortages. By using the DSO calculator, you can make more informed decisions about when to extend credit and when to collect payments. Starting accounts receivable.